MARKET INSIGHT

Why Thailand Branded Residences Are Leading The Way

December 04, 2025 • Author: Richard Bradstock

Share On:

The Best Locations to Buy a Branded Residence

North America used to be THE place for branded residences, which makes sense considering The Four Seasons were the pioneers in Boston in the 1980s. But recently, the globally uniform service and decor of The Four Seasons has fallen out of favour with travellers seeking a more authentic experience. Anyone who has stayed in a Four Seasons will know that inside the walls, you could be anywhere in the world from Singapore to Seattle.

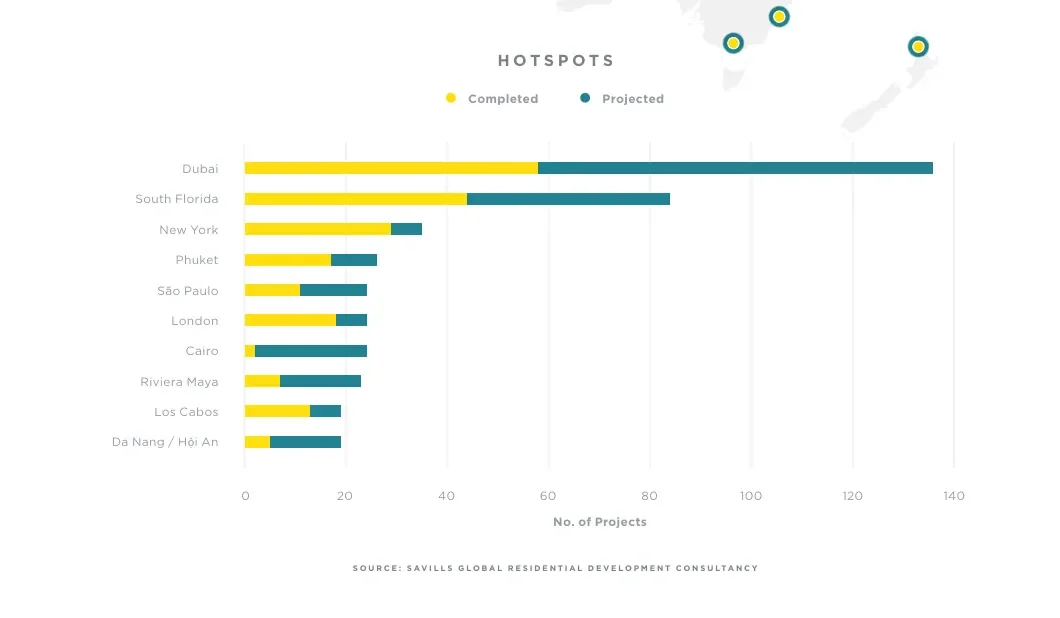

Dubai leads the table for the sheer volume of branded residential developments, but looking at the graph below, one might question whether that is a stable ratio of completed projects to future pipeline. It is often the case that branded residences in established metropoles fail to live up their hype. Commentators report sluggish sales and low growth for branded residences in London, Miami and Dubai, whereas the resort model of branded residences is showing strong growth.

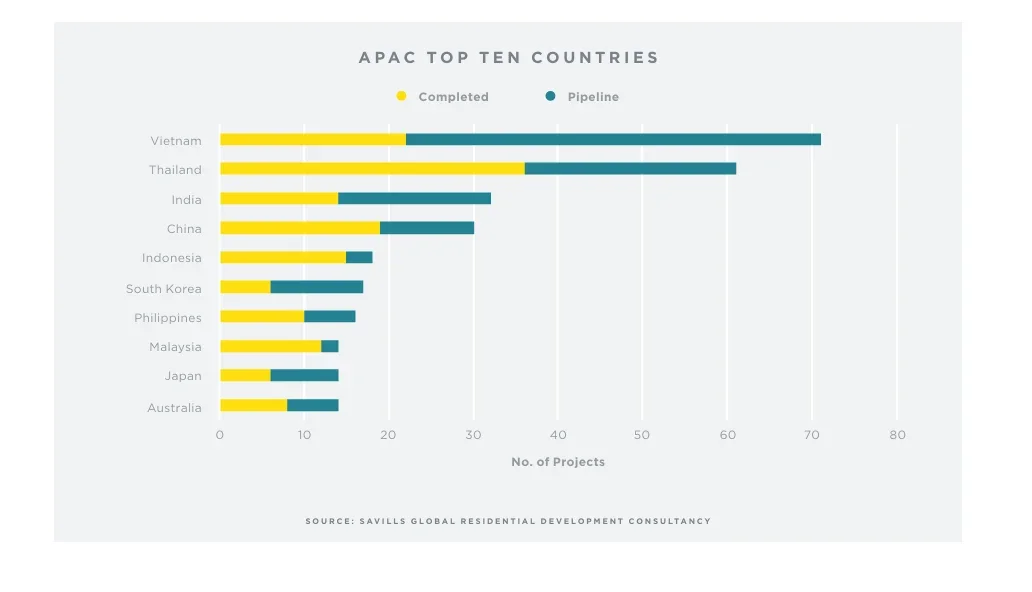

Thailand is the Leading Location for Branded Residences

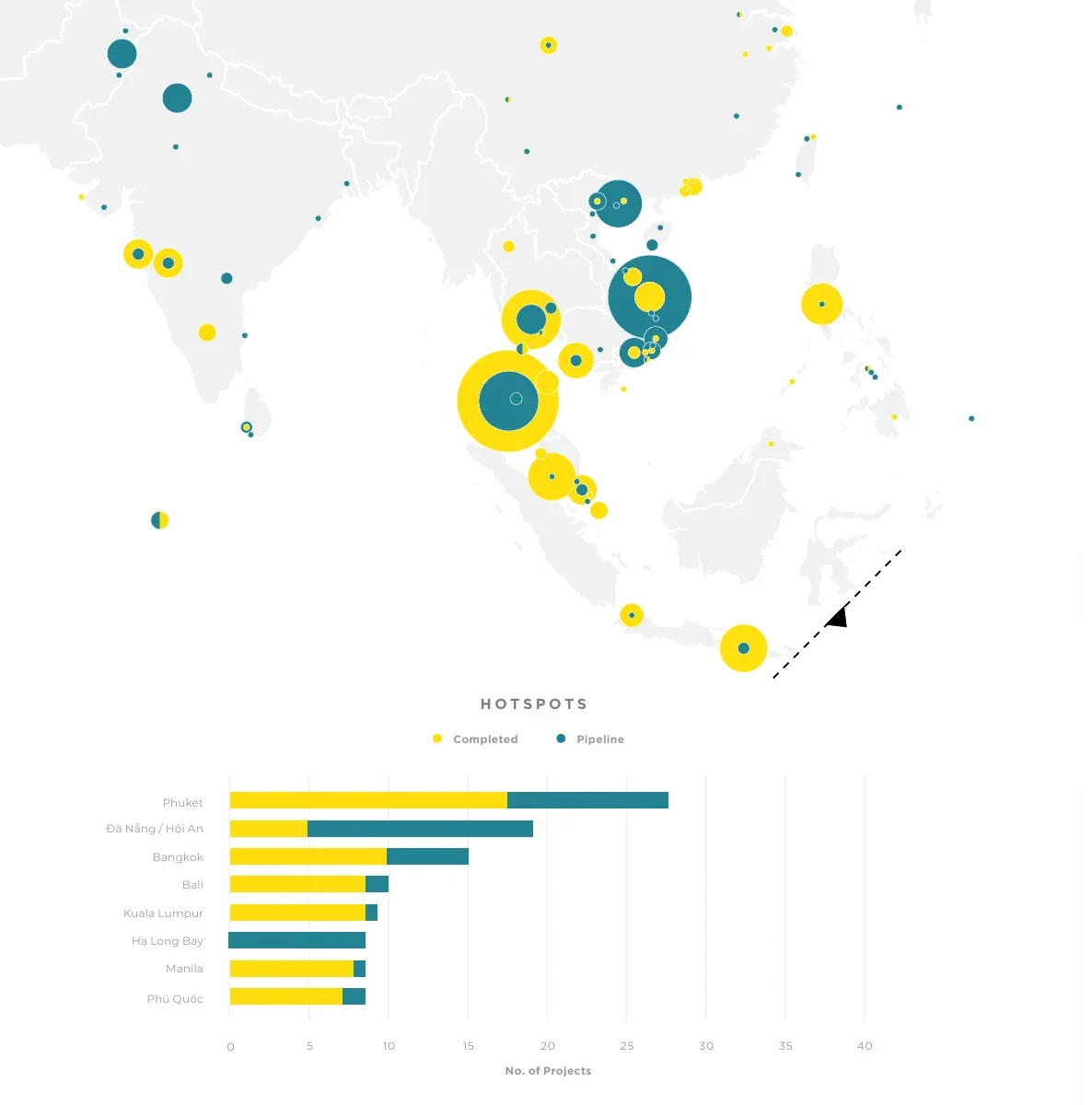

A major hub for tourism, attracting guests from all over the globe Thailand is a top, if not the best all-round performer for property investors looking for branded residences. And the recent TV sensation, The White Lotus, has only driven demand further. Looking at the graph below Thailand exhibits a strong ratio of completions to planned, making for a more stable and less speculative market. And here, resort-orientated residences are the preferred model.

In Asia, leadership in brand residences is shared equally between Four Seasons and Banyan Tree, but in terms of investor appeal, when it comes to margins, Banyan has the edge with a range of price points – all underpinned by the quality and reliability of the Banyan brand.

Established in 1994, Banyan Tree was the first to showcase the beauty of East Asian architecture and as such their hotels have benefitted hugely from the spoils of global travellers craving authentic experiences. Banyan is now regarded as one of the world’s leading hospitality groups with Accor Group owning a 5% stake. In a market that is about to become crowded with new unproven brands, this is exactly the kind of pedigree investors should seek; a proven brand with an excellent track record.

As Ho Kwon Ping, Founder and Executive Chairman of Banyan Tree Holdings, recently shared on a podcast, “Banyan Tree has worked on an ecosystem of partnerships with Accor and Chinese-based Vanke which has allowed them to retain their identity whilst benefiting from Accor’s business development and distribution networks. By formulating a co-management deal, Banyan Tree has also been able to retain control over the brand management aspects of their hotels, while Accor manages the operations, thereby creating a win-win situation for both companies” - and those who invest.

Phuket is the leading location for branded residences within Thailand with Banyan Tree the name behind the island’s most popular resorts. And interestingly, they offer investors lower capital outlays. Savills estimate that branded residences have a cost premium of 27-33% and in some emerging markets can be up to 45% more expensive than comparable luxury local stock, however, Banyan Tree residences in Phuket offer a 23% brand premium. Savills state: “Buyers of such residences are less driven by emotion or brand affinity and are therefore less likely to pay a premium as this would adversely affect yields and investment returns.” The bottom line: Thailand is the savvy branded residence investment delivering better returns for property investors.

The RPA Checklist For Buying Branded Residences

1

BRAND

Does it have global appeal and a proven track record not only in build quality but in operation and management?

2

Amenities and location

Resort locations lead the pack, but what facilities are included and how accessible is it? For example, Banyan’s Skypark Elara is in Laguna Phuket – one of the best integrated upscale resorts in the world, attracting travellers from across the globe.

3

Fees & Management Pool

What are the monthly and annual fees and do you have access to the operator’s rental pool?

4

Calculate your net yield

What exact income will you be left with once all the management fees have been paid? Base your calculations on a net yield – not gross.

Want rental yields between 7-11%? And a 15% capital growth in one year?

Get expert guidance on buying international property

FEATURED PROPERTY

skypark elara

From THB 8,500,000

20% Downpayment

About the author

RPA’s founder, Richard has worked in residential development investment for 20 years and oversees the general running of the business ensuring the RPA Group retains true to its founding principles. Over his career Richard has built an incredible network of international property investors and like-minded industry professionals.

Founder & Managing Director

richard bradstock

READ OUR PREVIOUS BLOG POST

Trusted by Our Clients

Discover why our clients love working with us and how our expert guidance helps them navigate the UK property investment market with confidence.